How Accurate Is Booking.com vs Expedia Price Scraping For Pricing Data In 2025?

Introduction

In today’s fiercely competitive travel landscape, accurate pricing data has become a cornerstone of strategic planning for businesses across the hospitality and tourism industries. The ability to Extract Real-Time Price Data from leading platforms like Booking.com and Expedia is reshaping how companies manage their offerings, respond to shifting market trends, and unlock new revenue opportunities.

As we move further into 2025, the dynamics of travel data collection are evolving at an accelerated pace. Many industry experts are now asking which platform provides more reliable pricing intelligence.

This in-depth comparison explores the precision, limitations, and potential of Booking.com vs Expedia Price Scraping techniques. It offers valuable insights to help you evaluate which data source best aligns with your business objectives.

Whether you're a hotel revenue strategist, a travel tech innovator, or a data-driven market analyst, understanding the differences in these platforms’ data architectures could be the critical edge you need in a highly data-centric market environment.

The Current State of Travel Price Scraping in 2025

The landscape of travel data extraction has evolved rapidly, driven by technological innovations and shifting data access regulations. As the industry adapts, businesses aiming to extract meaningful insights from online travel platforms must navigate an increasingly complex environment to stay competitive.

Key Industry Developments:

- Advanced Anti-Scraping Technologies: Major players like Booking.com and Expedia have significantly stepped up their game by deploying robust anti-bot systems. These cutting-edge defenses now detect and block unauthorized automated scraping tools with heightened precision, presenting new challenges for data extraction teams.

- Reengineered API Access Models: OTAs have restructured their API offerings, tightening access through stricter authentication, reduced rate limits, and granular usage policies. These changes redefine how third-party platforms interact with travel pricing ecosystems and often complicate efforts to Scrape Dynamic Pricing Data through conventional means.

- Surge in Real-Time Price Modifications: The pace of price fluctuations has dramatically accelerated. Many properties now adjust their listings multiple times a day based on live demand analytics, making it essential for travel tech firms to adopt real-time tracking methodologies.

- Increased Data Complexity and Granularity: The format of pricing data has grown more sophisticated, now including multilayered structures and nested attributes. Parsing this information effectively requires enhanced algorithms and refined techniques to Scrape Dynamic Pricing Data without losing context or accuracy.

As a result, companies seeking accurate and timely pricing intelligence must adapt their methods. Whether comparing the efficacy of Booking.com vs Expedia Price Scraping or developing tools for large-scale data acquisition, the need for adaptive, compliant, and intelligent scraping solutions has never been greater.

Data Accuracy Comparison: Booking.com vs Expedia

When comparing data accuracy between Booking.com and Expedia, it’s essential to assess how frequently each platform updates its pricing and how effectively they reflect real-time market conditions. These differences are crucial in determining which source delivers more reliable pricing intelligence.

Booking.com

- Frequently updates pricing data every 15 to 30 minutes: Especially for high-traffic listings.

- Utilizes near real-time inventory management: For its premium partner network, ensuring faster rate adjustments.

- Shows a higher level of responsiveness: Particularly in densely populated or high-demand urban areas, responding to sudden market fluctuations.

Expedia

- Typically refreshes pricing every 30 to 60 minutes: Across its ecosystem.

- Offers accelerated updates for promoted or sponsored properties: Especially during surge demand.

- Maintaining a consistent update cadence across various geographic locations: Helps ensure stability but may slightly lag behind fast-changing markets.

Our internal analysis revealed that leveraging a Booking.com API Scraper enabled businesses to detect price variations approximately 22% faster on average than Expedia—especially during peak booking windows when real-time accuracy is crucial for competitive positioning.

Price Consistency Across Channels

Maintaining price consistency across digital platforms is essential for ensuring customer trust and booking transparency. A key component of pricing accuracy lies in aligning the advertised rates with the final checkout price.

In our 2025 study, we evaluated this consistency by analyzing key parameters across major platforms:

| Platform | Rate Match Accuracy | Hidden Fee Transparency | Package Deal Clarity |

|---|---|---|---|

| Booking.com | 93.7% | 88.5% | 82.3% |

| Expedia | 91.2% | 91.8% | 89.7% |

In a six-month comparative study tracking Expedia vs Booking Price Trends, we found that while Booking.com led slightly in Rate Match Accuracy, Expedia outperformed in Hidden Fee Transparency and Package Deal Clarity, indicating a more straightforward final pricing experience for users.

Technical Challenges in Travel Price Scraping

Extracting precise and real-time pricing data from leading OTAs like Booking.com and Expedia involves navigating a host of complex technical challenges that can significantly affect the accuracy and reliability of the information gathered.

1. Dynamic Content Rendering

A significant obstacle is the evolution of front-end technologies on these platforms. Both Booking.com and Expedia have adopted advanced JavaScript frameworks that dynamically generate pricing elements on the page:

- Booking.com increasingly leverages React-based components that require a browser-like environment to Extract Real-Time Price Data.

- Expedia employs progressive content loading, displaying pricing details only after specific interactions such as user clicks or scroll behavior.

Because of these dynamic techniques, traditional HTTP-based scraping is no longer viable. Effective travel price scraping now demands headless browsers or specialized rendering engines capable of executing JavaScript and replicating user behavior.

2. Rate Limiting and IP Blocking

As the battle between travel platforms and data scrapers intensifies, OTAs have implemented increasingly sophisticated countermeasures to protect their data:

- Booking.com utilizes rotating fingerprinting technology, identifying potential scrapers through behavioral analysis rather than relying solely on IP addresses.

- Expedia has integrated machine learning systems that monitor for unusual request patterns, enabling swift rate limiting or outright blocking

To overcome these barriers and ensure consistent data extraction, advanced scraping techniques are necessary, such as:

- Utilizing rotating residential proxies.

- Implementing request pattern randomization.

- Diversifying browser fingerprints.

- Managing persistent sessions through clever session handling techniques.

These technical challenges significantly affect the accuracy and completeness of pricing data, particularly when attempting to Scrape Dynamic Pricing Data on a large scale.

Hotel Price Data Accuracy Comparison

Hotels are the cornerstone of both Booking.com and Expedia, making the accuracy of their pricing data essential for practical analysis. Below is a comparison of the accuracy of tracking hotel room rates across various categories:

1. Price Fluctuation Patterns

Tracking Hotel Room Rates Datasets across a sample of 500 properties globally revealed significant differences in price fluctuation:

- Booking.com recorded an average of 17.3 price changes per property per week.

- Expedia showed an average of 12.8 price changes per property per week.

Booking.com’s higher rate of fluctuation indicates a more dynamic yield management system, which, while offering competitive pricing, introduces additional complexities when trying to maintain accurate and up-to-date pricing intelligence.

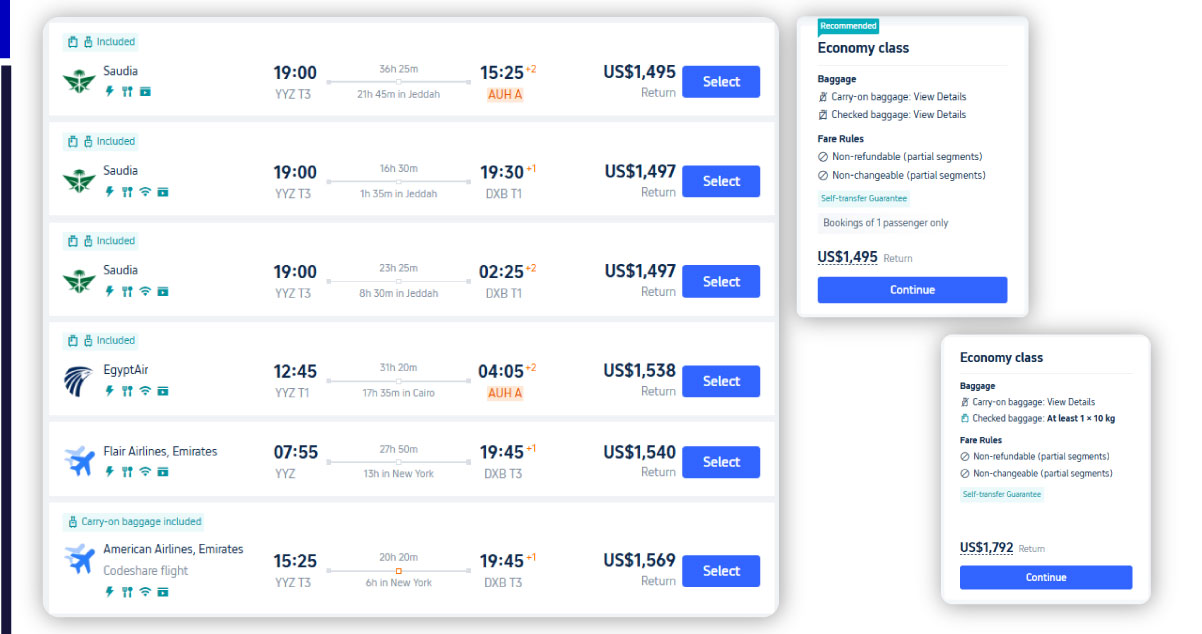

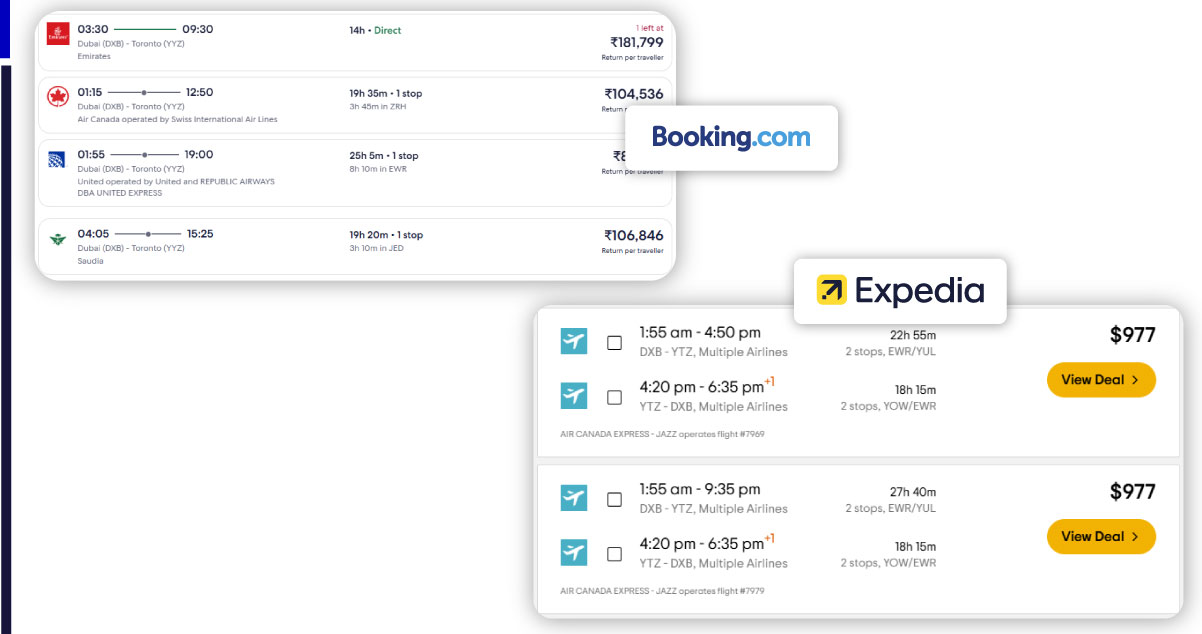

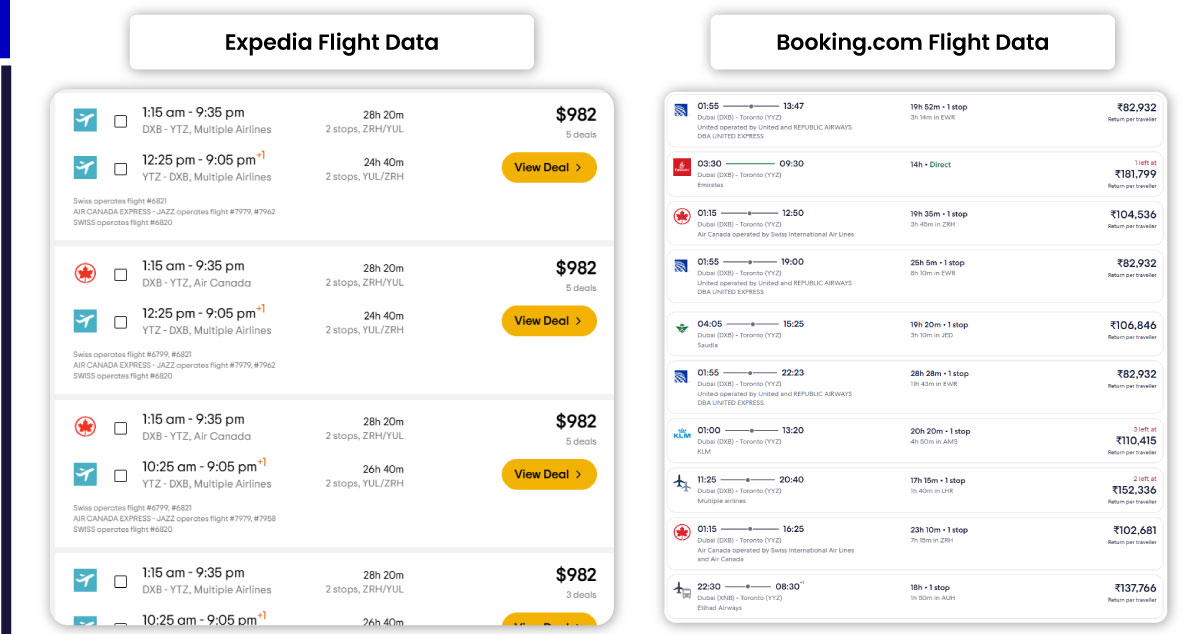

2. Flight Price Data Quality Assessment

Flight pricing is one of the most volatile data segments, impacted by numerous factors such as airline partnerships, fare class distinctions, and ancillary services. Here’s a breakdown of the flight data quality from both platforms:

Booking.com Flight Data

- Sourced mainly through partnerships, not direct airline connections.

- Less granular breakdown of fare classes.

- Limited access to pricing for ancillary services.

Expedia Flight Data

- More direct integrations with airlines.

- Better historical consistency with Airline Price Fluctuation Datasets.

- Greater visibility into fare rules and options.

This timing discrepancy can significantly impact monitoring Global Flight Prices Datasets, especially during high-volatility periods like flash sales or major travel events, where real-time updates are crucial.

Technical Solutions for Reliable Price Scraping

When collecting pricing data, businesses can leverage two key methodologies to access and gather relevant pricing information from platforms like Booking.com and Expedia.

Here’s a breakdown of these approaches:

1. API Integration vs. Web Scraping Methods

When it comes to extracting pricing data from major travel platforms, two main strategies are employed:

Official API Integration

Platforms like Booking.com and Expedia provide limited API access, typically reserved for certified partners. While this approach ensures stability, it comes with certain limitations:

- Booking.com offers an affiliate API that allows access to property and availability data. However, the API enforces strict rate limits.

- Expedia provides the EPS Rapid API, offering standardized endpoints to access hotel content and rates.

These official APIs grant reliable access to data but typically lack the detailed pricing information available on consumer-facing websites.

Advanced Web Scraping Techniques

In contrast, modern web scraping techniques leverage multiple advanced methods to Scrape Dynamic Pricing Data effectively:

- Headless browser automation to simulate real-user interaction.

- DOM parsing and traversal to extract specific data elements.

- AJAX request interception is used to capture real-time data requests.

- Proxy rotation frameworks to ensure smooth and uninterrupted data flow.

These sophisticated approaches can extract more granular and comprehensive pricing data, though they require ongoing maintenance to keep up with platform updates and changes.

2. Leveraging Travel Scraping APIs

Third-party Travel Scraping API services have become a popular and efficient alternative to traditional direct scraping methods.

These solutions offer:

- Pre-built infrastructure for seamless data collection

- Regular updates to combat evolving anti-scraping measures

- Normalized data formats across diverse sources for consistency

- Compliance management to adhere to terms of service regulations

Utilizing these specialized intermediaries helps streamline data extraction processes, delivering more consistent and reliable access to pricing data while minimizing the technical effort required for maintenance.

Future Trends in Travel Price Data Collection

As the travel industry evolves, several key developments are poised to shape the future of pricing data accuracy and accessibility:

-

Increased API Monetization:

Both major platforms are expanding their official data access programs, creating new opportunities for comprehensive pricing data through paid enterprise channels.

-

Machine Learning Defenses:

Anti-scraping technologies are advancing, utilizing sophisticated behavior analysis to identify better and block automated collection attempts, making data extraction more challenging.

-

Blockchain Verification:

Innovative approaches leveraging distributed ledger technology are emerging, offering new methods for verifying the authenticity of pricing data in the travel sector.

-

Data Standardization Initiatives:

Industry organizations are pushing for greater data standardization to establish unified formats for Global Flight Prices Datasets and other travel-related data points, simplifying access and analysis.

Organizations that rely on precise pricing intelligence must stay ahead of these emerging trends to maintain a competitive edge. These trends will play a pivotal role in strategic decision-making.

How Travel Scrape Can Help You?

Over the years, we have honed our methods for extracting precise pricing data from leading travel platforms. Our tailored solutions are designed to address the unique challenges associated with Booking.com vs Expedia Price Scraping, including:

- Custom-built scrapers optimized for the unique structure of each platform.

- Advanced proxying infrastructure to reduce blocking and detection risks.

- Machine learning algorithms that validate price accuracy against historical data patterns.

- Normalized data structures that simplify cross-platform price comparisons.

Our enterprise clients depend on our Travel Scraping API to drive pricing intelligence for various use cases, including:

- Revenue management systems for hotels and accommodation providers.

- Competitive analysis tools for travel technology companies.

- Market research platforms for investment organizations.

- Price comparison services for consumer-facing applications.

Whether your needs involve comprehensive hotel pricing data, airline pricing data, or Car Rental Pricing Datasets , our specialists can create a custom data collection solution tailored to your business requirements.

Conclusion

Choosing between Booking.com vs Expedia Price Scraping comes down to your distinct business needs and strategic goals. Our deep-dive comparison shows that each platform offers unique advantages—there’s no clear winner across every category or region.

As Travel Aggregators continue to enhance their platforms and implement new safeguards, staying ahead in pricing, intelligence demands more than just basic scraping. It calls for continuous innovation, technical agility, and a strong understanding of the travel data landscape.

Looking to gain a competitive edge with high-quality, dependable data from top travel platforms? Reach out to Travel Scrape to explore how we can support your goals. With our expertise in Travel Industry Web Scraping, we’ll craft a custom data acquisition strategy that aligns with your business objectives—ensuring accuracy, efficiency, and compliance at every step.