How Web Scraping Car Sharing Trends Predict the Future of the P2P Rental Market?

Introduction

The transportation industry is undergoing a significant shift, driven by the rise of digital platforms reshaping traditional car ownership and rental concepts. Through Web Scraping Car Sharing Trends, businesses and analysts can unlock valuable insights into evolving consumer preferences, dynamic pricing models, and the overall progression of the peer-to-peer (P2P) car rental market.

Understanding the P2P Car Sharing Revolution

The car rental industry is undergoing a significant transformation, fueled by the rise of platforms like Turo, Getaround, and HyreCar. These peer-to-peer platforms empower individuals to become micro-entrepreneurs in the mobility sector. These peer-to-peer platforms allow vehicle owners to generate income by renting unused cars, introducing a disruptive shift in traditional rental models.

Current peer-to-peer car-sharing trends indicate an annual growth rate of nearly 20%, with forecasts projecting the global market to surpass $20 billion by 2032. This rapid expansion is propelled by evolving consumer behaviors, increasing environmental awareness, and a growing preference for access over ownership.

Access to reliable, large-scale data is critical to truly grasping the dynamics of this evolving landscape, and this is where web scraping becomes a vital tool for generating actionable market intelligence.

The Power of Data Extraction in the Car Sharing Economy

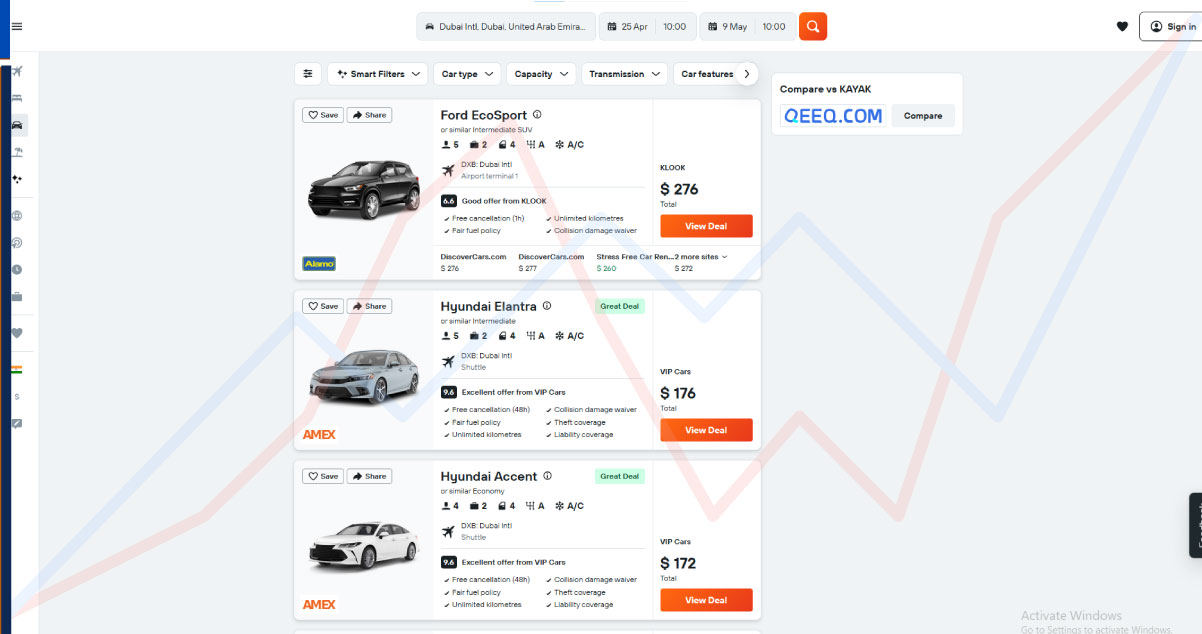

In the evolving landscape of shared mobility, leveraging Car Sharing Marketplace Data Extraction has become essential for businesses aiming to stay competitive and data-driven. This process enables stakeholders to systematically collect and analyze valuable data points from car-sharing platforms, such as:

- Real-time vehicle availability across various geographic regions.

- Price fluctuations are influenced by supply-demand dynamics, rental duration, and vehicle categories.

- Emerging consumer preferences and recurring booking patterns.

- Key host performance metrics and strategies for improved listing optimization.

- Market shifts due to seasonal variations and external factors.

By choosing to Scrape P2P Car Rental Analytics, organizations can convert unstructured platform data into powerful, actionable insights. This enhances operational decision-making and fuels smarter pricing, inventory planning, and customer engagement strategies tailored to the demands of the car-sharing economy.

Key Data Points from Car Sharing Platforms

When businesses and analysts set out to Extract Data From Turo Car Sharing platforms or similar peer-to-peer (P2P) mobility services, they seek more than just numbers; they uncover insights that shape strategy and predict trends.

Below is a detailed look at the most valuable data points often targeted during such data extraction efforts:

1. Pricing Intelligence

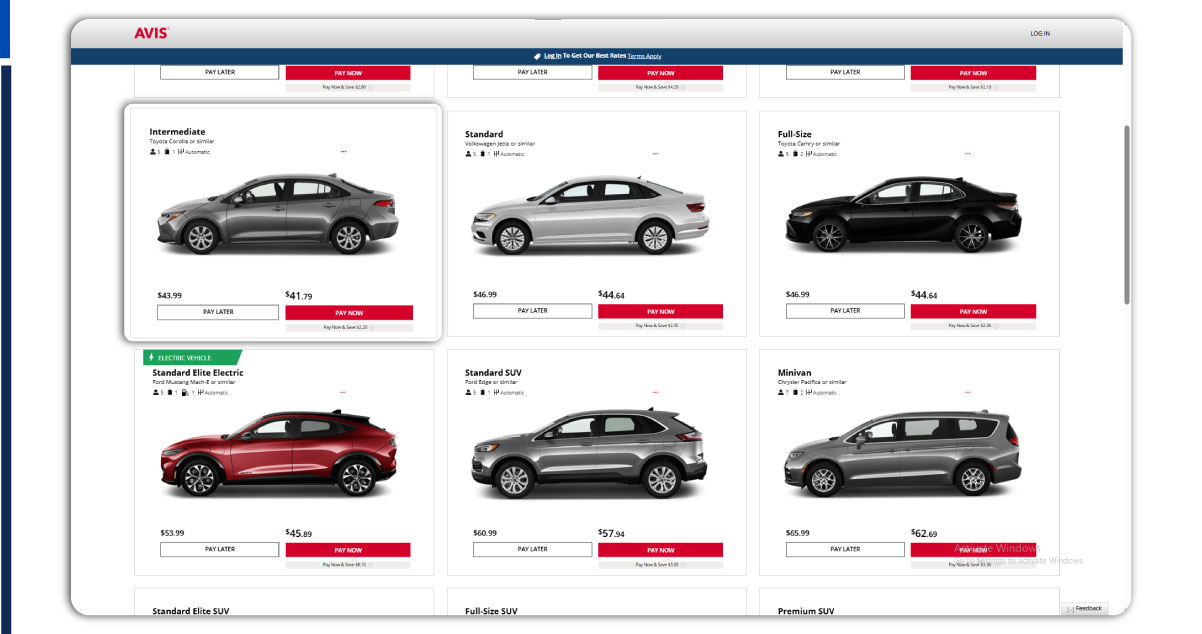

Understanding pricing trends is crucial for revenue optimization and competitive positioning.

Analysts dive into:

- Base pricing structures across various vehicle classes

- Shifts in dynamic pricing during high-demand periods

- Add-on features that justify premium pricing

- Discounting tactics and how they influence conversion rates

2. Vehicle Performance Metrics

Performance tracking helps identify which vehicles offer the best returns on investment.

This involves analyzing:

- Top-performing vehicle models by geographic location

- Fleet-wide utilization rates to gauge efficiency

- Correlation between vehicle age and income generation

- Features that consistently attract more bookings

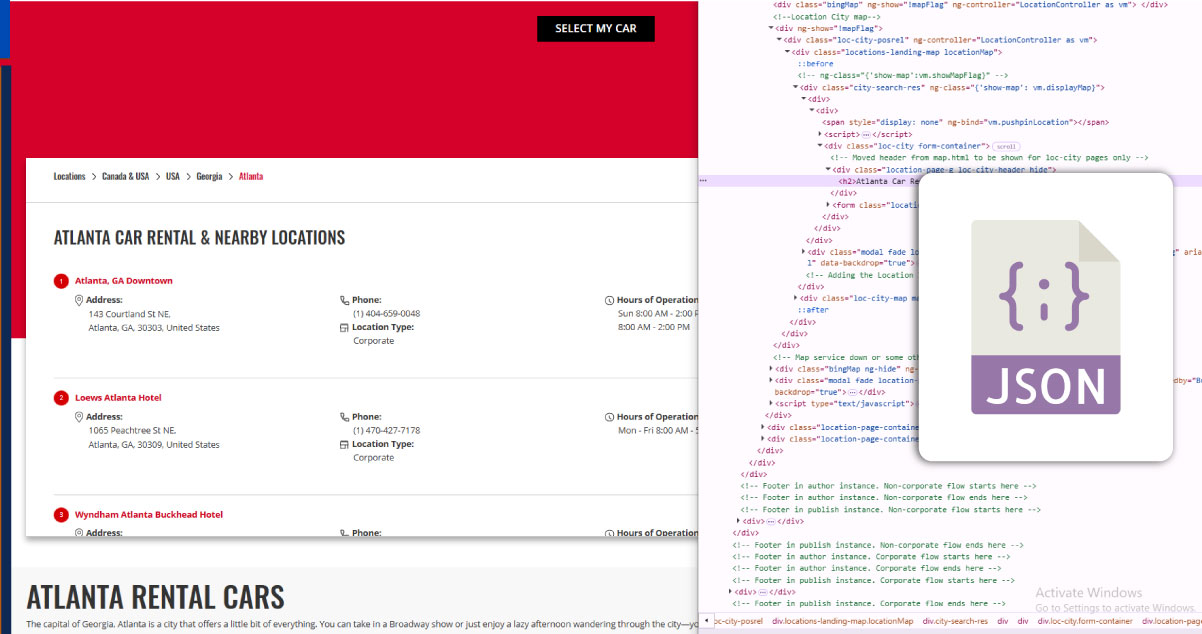

3. Geographic Insights

Location data is central to understanding demand concentration and growth potential.

Key geographic metrics include:

- High-demand zones for P2P rentals in urban and suburban settings

- Seasonal rental spikes linked to tourism trends

- Value differentiation for listings near major airports

- Rising neighborhoods showing increased rental interest

4. User Behavior Analysis

A clear view of user behavior reveals patterns that help personalize offerings and boost engagement.

This analysis covers:

- Lead times in bookings across diverse demographic groups

- Typical rental duration per customer type

- Frequency and behavior of repeat renters

- Feature and vehicle preferences based on user segments

These data insights form the backbone of advanced predictive modeling, enabling businesses to Extract Data From Turo Car Sharing platforms and stay ahead of evolving market dynamics.

How to Web Scrape Turo Availability Effectively?

Extracting reliable data from platforms like Turo requires a strategic and ethical approach to web scraping. To achieve accurate and consistent insights, it’s essential to implement techniques that balance performance with compliance. Below is a detailed framework for Effectively Web Scrape Turo Availability and turning raw data into actionable market intelligence.

1. Ethical Scraping Setup

A responsible and effective scraping strategy starts with aligning with ethical standards and platform-specific constraints.

Key considerations include:

- Applying intelligent rate-limiting strategies minimizes server overload or IP blocking risk.

- Adhering to robots.txt directives and always respecting Turo’s terms of service.

- Utilizing rotating proxies to diversify traffic sources and prevent detection or access denial.

- Configuring request headers to simulate authentic browser behavior, enhancing the reliability of data capture.

2. Data Structure Parsing

Success in data extraction depends heavily on your ability to interpret the structure of the platform’s front-end and back-end data sources:

- Isolating and mapping essential data elements from HTML or JSON responses.

- Building robust and scalable data schemas that ensure consistency across scraping runs.

- Addressing JavaScript-rendered content using headless browsers or rendering engines when required.

- Navigating pagination and filtering/search parameters to ensure complete data coverage.

3. Temporal Analysis Configuration

To gain deeper market insights, it's crucial to monitor changes over time rather than relying on static snapshots:

- Automating scheduled scraping intervals to track price fluctuations and availability shifts.

- Identifying and analyzing seasonal trends in vehicle listings and customer demand.

- Monitoring the influence of special events or regional activity on car availability and pricing.

- Uncovering pricing strategy adjustments made by hosts in reaction to market conditions.

4. Data Cleaning and Normalization

Raw data often contains inconsistencies and noise. To make it actionable, it must be cleaned and standardized:

- Creating a unified taxonomy by standardizing vehicle categories across entries.

- Normalizing location data to enable accurate regional or city-level comparisons.

- Systematically handling incomplete data fields to maintain integrity across your dataset.

- Detecting and excluding outliers or anomalies that could skew results or mislead analysis.

When done right, these techniques to Web Scrape Turo Availability Effectively yield a powerful stream of real-time, structured data. This data becomes a core asset for competitive benchmarking, pricing optimization, and market forecasting.

Predictive Insights from Car Rental Data Scraping Services

The real power of Web Scraping Car Sharing Trends lies in data collection and unlocking predictive intelligence that drives strategic decisions. When raw datasets are transformed into forward-looking insights, businesses gain a competitive edge in the evolving P2P car-rental landscape.

Here are some of the emerging trends and forecasts derived from Car Rental Data Scraping Services:

1. Growing Specialization and Niche Markets

An in-depth analysis of Turo Car Rentals Data Scraping uncovers the increasing trend of specialization within the peer-to-peer (P2P) rental market. While economy cars continue to lead in overall volume, premium experiences are significantly boosting profitability:

- Luxury vehicle listings have increased by 35% year-over-year, highlighting the rising demand for high-end rentals.

- Adventure-ready vehicles such as 4x4s and camper vans are experiencing 40% higher utilization rates, reflecting the growing popularity of outdoor and adventure travel.

- Electric vehicles command a 15-20% premium pricing even as their supply expands, indicating strong demand despite the influx of new options.

- Vintage and classic cars are achieving the highest per-day revenue, emphasizing the appeal of unique and nostalgic rental experiences when available.

This shift signals that the P2P market will increasingly evolve into highly specialized experience categories, moving away from a one-size-fits-all, commoditized service model.

2. Geographic Expansion Beyond Urban Centers

Through detailed analysis of Car Rental Location Datasets, we observe a significant trend in the expansion of P2P rentals, moving beyond traditional urban hubs:

- Suburban listings are growing at a robust 28% annually, compared to a more modest 18% growth within urban core areas.

- Small cities with populations between 100k-250k are seeing the highest year-over-year growth rates in car rental offerings.

- Rural tourist destinations are witnessing seasonal demand spikes that surpass urban rental rates, highlighting emerging trends in travel patterns.

- University towns exhibit distinctive rental behaviors, with patterns heavily influenced by academic calendars.

These findings underscore how the P2P rental model is dynamically adapting to cater to markets historically overlooked by traditional car rental agencies, ensuring broader coverage and more diverse options for consumers.

3. Price Optimization Through Dynamic Algorithms

Analyzing Car Rental Pricing Datasets uncovers increasingly advanced pricing strategies, which are adapting to market conditions and consumer behavior:

- Day-of-week price fluctuations are becoming more noticeable, with up to a 45% price difference depending on the day.

- Last-minute availability is becoming a valuable revenue driver, enabling premium pricing opportunities for booking closer to the rental date.

- Strategic long-term rental discounts are being applied more strategically, enhancing rental business margins by targeting specific customer segments.

- Event-based pricing is becoming more responsive and adaptable to local market conditions, further driving dynamic pricing decisions.

These insights indicate that car rental platforms and hosts continue refining their pricing strategies, focusing on leveraging total revenue optimization. This shift highlights the growing importance of pricing intelligence in shaping more intelligent, more effective pricing algorithms.

4. Host Professionalization

Insights gathered through Car Rental Data Scraping Services reveal a significant transformation in the host landscape, with a growing shift toward professionalism and operational sophistication.

- Multi-vehicle hosts are expanding rapidly, increasing their share of available inventory on rental platforms by 25% year over year.

- These professional hosts see up to 22% higher utilization rates than casual, single-vehicle hosts.

- Top-tier hosts are moving toward fleet standardization, optimizing their vehicle lineup for operational efficiency and brand consistency.

- Additionally, service add-ons such as insurance bundles, flexible delivery options, and loyalty perks are strategically used to differentiate offerings.

Collectively, these developments highlight the formation of a distinct middle market segment—bridging the gap between legacy car rental agencies and informal peer-to-peer rentals.

How Travel Scrape Can Help You?

We deliver customized Car Rental Data Intelligence solutions tailored to meet the unique demands of today’s dynamic P2P vehicle rental ecosystem. Our offerings are designed to empower your strategic decisions with precise and actionable data.

Here's how we support your growth:

- Custom data extraction from all major P2P car-sharing platforms to give you complete visibility into listings, availability, and performance metrics.

- Real-time pricing intelligence and competitive monitoring keep you ahead of market trends and competitor moves.

- Geographic opportunity analysis for fleet placement to help you identify high-demand zones and optimize location-specific asset distribution.

- Consumer trend research and preference mapping are needed to understand shifting customer behaviors and expectations.

- Historical data analysis and future projections to guide long-term planning and forecast market shifts with confidence.

Our powerful Travel Scraping API ensures seamless access to structured datasets, enabling smooth integration into your existing business intelligence systems.

Conclusion

The P2P car-sharing marketplace continues to evolve rapidly, with data as the critical factor separating successful participants from those left behind. By leveraging Web Scraping Car Sharing Trends, businesses can anticipate market shifts, optimize their offerings, and capitalize on emerging opportunities.

As Travel Aggregators increasingly incorporate P2P options alongside traditional rentals, the boundaries between rental segments will blur further. The companies that thrive will be those with the best data-driven insights guiding their strategies.

If you're ready to harness the power of data in your car-sharing business, We are your ideal partner. Our specialized Travel Industry Web Scraping solutions provide the intelligence you need to make confident decisions in this dynamic marketplace. Contact Travel Scrape today to discuss how our custom data solutions can give you a competitive edge in the evolving world of peer-to-peer car rentals.